FAQ

REAL ESTATE

IN LAS TERRENAS

Find all the answers to the most frequently asked questions about Real Estate in Las Terrenas, Samaná, the Dominican Republic. The legal process to buy real estate, returns on investment, tax exemptions, legal fees…

What is the return on investment of real estate in Las Terrenas?

Las Terrenas benefits from high rental rates thanks, among other things, to its international tourism and exceptional beaches.

The yearly return from rentals varies from 6% up to 15% net on your investment. Your local real estate agent will know about the best investment properties with the highest potential for returns.

In addition to rental revenues, the growing demand for real estate in Las Terrenas over the last couple of years is starting to push the property values up. This trend has an immediate effect on capital gains.

It is thus a good timing for buyers to enter the market before prices go up.

There is a new wave of investors arriving in Las Terrenas today from the United States and Canada. Before that Las Terrenas was mainly constituted by Europeans.

The rental rates and occupancy depend on several factors:

- Location, properties closer to the beach or with ocean views are obviously more demanded

- Amenities such as a swimming pool, restaurants, bars,...

- Access to the property

- Marketing of your property (AirBnb, Booking, HomeAway…)

- Interior Design

- Equipment included (TV, Internet, Kitchen...)

What is the market price of real estate in Las Terrenas?

When looking to invest in a property, one of the first questions that comes to mind is the following: “Is the asking price above or below the market value for that property?”.

To assess the actual market value of real estate, taking the emotional value out of the equation, there are several elements to take into consideration:

- The state of the property

- The quality of the construction

- The location

- The size of the property

- The features

- The amenities

Another way to properly assess the value of a property is by comparison with similar properties for sale locally.

When you are not too familiar with the area, your best ally is your real estate agency. A reliable broker has knowledge of the local real estate business and can quickly tell you if a property is overpriced or below its actual market price.

What are the costs and taxes in a real estate transaction?

Legal Taxes and Fees:

- 3% fee for the Transfer of the Title of property

- 1% to 1.5% for the Legal Fees (Notary, Due Diligence process)

- 1% Annual Property Tax (IPI)

The broker's commission is paid by the seller and is included in the selling price.

Can foreigners purchase a home in the Dominican Republic?

Foreigners benefit from the exact same property rights and obligations as the Dominican citizens. There is no restriction whatsoever for foreigners willing to purchase real estate. The passport and ID suffice to enter in a real estate transaction.

Do I need the services of a real estate agency?

Choosing a well-established real estate agency when buying a property in the Dominican Republic is of prime importance. Whether you are new to real estate or to the island, there are several factors and knowledge to take into consideration before investing in a property.

In one sentence, working with professionals will get you more security, less headaches, more insights, more options on the market and in the end a better price.

Discover the Ocean Edge team here: More About Us

How to choose the right real estate agency?

With many real estate offices in activity in Las Terrenas, it is important to choose the right broker. Here are a few criteria to consider when selecting your real estate agency:

- A well-built website with friendly navigation for the users

- A wide range of properties presented with quality pictures, videos and all the useful information on the property

- Multilingual brokers for a clear and fluent communication between all the parties, buyers and sellers, bank, notary…

- A reactive broker that shows involvement in helping you find and conclude your real estate transaction under the best conditions

- It’s better to choose a local agency with local partnerships compared to franchised agencies abroad

Get to know the team at Ocean Edge Real Estate here: More About Us

What is the legal process to buy real estate in the DR?

For a detailed legal guide please read the following article:

GUIDE TO BUY A PROPERTY IN DOMINICAN REPUBLIC

The procedure when investing in real estate in the Dominican Republic is similar to the United States, Canada and Europe. First of all, you need to find the right home fitting your budget and your project.

You can search HOMES FOR SALE IN LAS TERRENAS here and contact an agent to guide you in your property enquiry.

The legal buying process in 3 steps:

1 - The Purchase Offer

Once you are decided on a particular property, the first step is to send a formal written offer to the seller describing the main conditions under which you propose to purchase the property. This Purchase Offer, usually sent via email, includes details such as the purchase price, the payment terms and more aspects if necessary. It is recommended to be as transparent as possible from the start.

When the seller is presented with your offer, they can either accept the proposal or send a counter offer with different terms, closer to their expectations.

This delicate process of negotiation is unique to each transaction. Hence the importance to discuss with your real estate agent to come up with the best possible offer.

2 - The Promise of Sale

The second step is the drafting and signing of the "Promise of Sale". In the Dominican Republic, the POS is a legally binding document which needs to be signed in front of a notary public.

All the terms of the transaction are established in that document; it will include the full names of both parties, references establishing identities (such as valid passports, driver’s license), a clause in case of default from either party, a legal description of the property, the final purchase price, the payment terms, the date on which the property is delivered, the exact date of the closing, etc.

When signing the “Promise of Sale", the buyer is required to wire the first payment as agreed between the parties. The amount usually varies from 10% to 20% of the purchasing price. Depending on the type of transaction, this payment is either placed in the escrow account of the legal office representing you, or sent directly to the seller’s account.

At the same moment, the notary public will proceed with the due diligence process.

3 - The Deed of Sale

The last step to finalize your real estate transaction is to sign the "Deed of Sale”. It is a formal document legally binding on both parties and signed in the presence of a notary public.

As mentioned, the legal office needs to request and verify all the necessary documents (Due Diligence) to ensure a proper transfer of ownership to the buyer.

This process can take as little as a few days or considerably more. The required time will vary according to the availability of the documents, the people and the complexity of the transaction. By experience, it usually takes 2 to 3 weeks.

Both parties need to be physically present (or their legal representatives via a Power of Attorney) in front of the Public Notary. The Deed of Sale will be read and signed by both parties. The real estate agent will accompany during the signature process.

All funds (amount agreed between parties in the "Promise of Sale") need to be readily available for transfer at the time of closing. The buyer and the seller will sign all the necessary documents. Once the seller attests reception of the funds and only then, the public notary will stamp the "Deed of Sale".

Now, the sale can be recorded at the “Registry Office of Titles" by your legal representative. In most cases, it takes around 1 to 2 months to get the property under your name (or your company's name).

What are the legal fees when purchasing a property in DR?

The legal fees are about 1%-1.5% of the amount agreed for the real estate transaction. This fee covers the services provided by the legal office conducting the legal process. It includes:

- Drafting of contracts (Promise and Act of Sale)

- Meetings

- Due diligence

- Transfer of ownership, Certificate of Title

In brief, all the steps required to verify the legal status of the property, redact the contracts and transfer the ownership to the buyer.

The buyer is accountable for the transfer and legal fees. All the other fees are payable by the seller.

What is the transfer tax when buying real estate?

The property transfer tax is the tax paid by the buyer to the registry of titles, in the region where the property is located. In the Dominican Republic, the property transfer tax is equal to 3% of the assessed value of that property. That value is different from the purchase price. It is the property value registered at the Internal Revenue Office. It is in general lower than the actual market value of the property.

For properties bought under a company, the due transfer tax is 2% of that company’s capital.

The principles are different for each transaction. We recommend that you get advice from a local notary / attorney to assess the best options for your investment.

Are there yearly property taxes in the Dominican Republic?

The Annual Property Tax (IPI) is applied on the total amount of the real estate value of a property.

For all real estate (homes and lots) owned by individuals whose values are registered below US$150,000, the property is exempted from the annual property tax.

Rates

Individuals: a rate of 1% is applied on the surplus value of RD$7,438,197 (or US$147,387 as of June 2019) of the property.

Trusts: 1% on the value of the real estate property. No exception.

Companies: 1% of the company capital.

The property tax is paid in two half-yearly installments, with the deadline for payment of the first installment on March 11 and the second on September 11. Good to know: the amount of tax assets paid by a company can apply as a credit to its revenues.

Exemptions

- The building (and the land on which it is built) belong to people over 65 years of age, provided that this is the only property owned by the same individual in the Dominican Republic

- Pensioners and rentiers from a foreign source (50%)

- Rural land and properties of agricultural use located on rural land

- All properties whose total value is equal to or less than (RD$7,438,197 / US$147,387)

What is the certification Confotur - Law No. 158-01 | Tax exemptions

The CONFOTUR Law is a government incentive to develop tourism areas of the Dominican Republic and promote the protection of the environment in these areas.

The benefits of this law can be granted to all individuals or legal persons domiciled in the country to promote or invest capital in tourism infrastructures, such as Real Estate.

Properties falling under CONFOTUR Law are exempt from all property taxes for a period of 15 years:

For individuals (first owners):

- Exemption from the 3% Transfer Tax for the transfer of the title

- Exemption from the 1% Annual Property Tax (IPI)

- Exemption from the Tax on Capital Gain when reselling the property

- Exemption from the Tax on rental income

For developers:

- Exemption from 100% of the National and Municipal taxes for the constitution of companies, for capital increase of already constituted companies, National taxes and Municipalities by transfer on real estate rights, by sales, swaps, contributions in nature and any other form of transfer on rights real estate, of the Tax on Sumptuary and Solar Unbuilt Housing (IVSS). This also includes all the fees for the preparation of the plans, the studies, consultancies and supervision of the construction to be executed in the tourism project in question, the latter being an exemption applicable to contractors responsible for the execution of the works

- Exemption from 100% of import taxes and other taxes such as fees, duties, surcharges, including the Tax on Transfers of Industrialized Goods and Services (ITBIS), which are applicable on machinery, equipment, materials and movable property that are necessary for the construction and for the first equipment and commissioning of the tourist facility from which about.

- Once a project is approved by CONFOTUR Law and granted all the above-listed benefits, investors are able to deduct their investments from their net taxable income

What is a “Deslinde"? Can I buy a property without the “Deslinde”?

A “Deslinde” is a title of ownership or “Certificate of title" defining the limits of a property and its rightful owners. You CANNOT rightfully purchase a property without a clear “Deslinde”.

This document also certifies that the property was surveyed by a geometer (with GPS points) and that all of its boundaries were defined from the original title. A blue “Deslinde” means that all is in order. That document is issued right after the property gets approved, it is cleared.

Recent updates to the Dominican Republic's Property Registry Law require that all real estate transactions must have a clear "Certificate of Title" recorded at the Property Registry. Prior to this law, the whole responsibility for having a Clear Title Certificate was left to the buyers.

It is now the responsibility of the legal representative of the buyer to verify that the property has a clear "Certificate of Title".

Dominican Republic’s Property Registry Law makes it clear that a property cannot be sold and recorded at the Property Registry without having a “Deslinde” together with a clear “Certificate of Title”.

How to make sure that a property is safe to buy?

You can make sure a property is safe to purchase thanks to 2 intermediaries: A trusted real estate agency and legal office. If you live in the Dominican Republic and personally know the seller, you could not deem necessary to use the services of a local real estate agency.

The best way to make sure that a property for sale is safe to buy is to seek the advice of a good local real estate agency. They will take the preliminary steps to ensure that the property is in order with its legal obligations. A professional broker will also make sure that surveys and titles are valid and up to date.

To ensure that the purchasing process runs smoothly it is strongly advised to secure the services of a reliable legal representative. The real estate agency will refer you to a trusted legal office which will provide all the legal information and take care of the due diligence process until the ownership is registered under your name.

They will require all the necessary documents from the seller or their attorney:

- Copy of the seller’s identification card or a copy of his/her passport,

- Copy of the Certificate of Title,

- Copy of the tax payment receipts, issued by the Internal Revenue Office,

- Copy of the original survey or plot plan (“Deslinde”) from the property.

In case that the seller originally bought the property as a condominium or the seller is a corporation, additional documents are required.

Are property owners covered by inheritance laws?

There is no restriction whatsoever on foreigners to inherit ownership of a property in the Dominican Republic.

- Citizens and Residents of the Dominican Republic will be happy to hear that the current tax-law reduced the inheritance tax to only 3% of the assessed value of the property

- For those beneficiaries who are living outside the Dominican Republic, the inheritance tax is 4.5%

A minimum share of the inheritance will have to be transferred to direct heirs, regardless of the existence of a will in a different country.

What is a rental pool program?

Some condominiums and hotels in Las Terrenas offer the owners in their project to join a Rental Pool Program. The rental pool is managed by a team of professionals that will take care of renting and maintaining your property while you are not here.

The objective is to maximize the return on your investment and guarantee a service of quality by combining the rentals from all the units in the rental pool.

The total revenues of the pool are redistributed to the owners, net of maintenance and management costs. The management team taking care of renting your unit will usually ask for a 15% - 20% commission on the rentals.

How is the process to buy land and build a house on it?

Once you have found the right land for your project:

- Submit a written offer through your local real estate agent

- When the terms of the transaction (price, timing, guarantees...) are agreed upon, use the services of a legal office / public notary to:

- Apply Due Diligence on that property

- Draft and signature of the "Promise of sale" describing the transaction terms

- Draft and signature of the "Deed of sale”

From that moment it takes roughly one month to transfer the title of ownership to the buyer’s name.

If you want to build a house on your land, your real estate agency can recommend reputable architects and constructors locally.

Here are the different steps to build a house:

- Send your requirements to one (or several) architects. Review the design together and get a quote for the construction of your custom house

- Sign a binding contract outlining the agreed terms, responsibilities and eventual penalties in case of non compliance

- Once you are the rightful owner of the land (the title is transferred to you), the architect will send the final floor plans to the competent authorities in order to obtain the construction permit. This process can take 2 to 3 months.

- Once you are in possession of the permits to build, the construction can start. The payment terms usually follow the construction phases.

Here is a typical payment structure on a new construction:

- Signature of the Compromise of sale | 10%

- Land preparation & Laying foundations | 20%

- Walls and Roofs | 25%

- Finishes | 30%

- Delivery of keys | 10%

- Reception of the title of ownership | 5%

Want to know more? Visit our page: Build your home in Las Terrenas

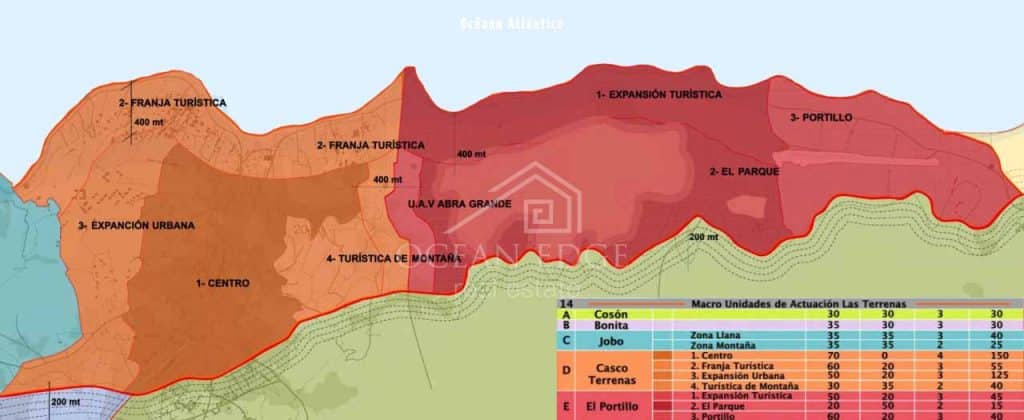

What is the building density?

Every region in the Dominican Republic has distinct rules in terms of construction density.

In Las Terrenas and the Samana Peninsula, for example, different building areas have been defined, each zone having its specific regulations in terms of construction.

The most relevant rule is the building density. It represents the number of bedrooms allowed per hectare (=10,000 m² or +/- 2.5 acres)

If you are looking to develop a project such as a condominium or a hotel, it is important to verify the building density of the land you want to acquire. Ask your real estate agent for that information!

Below is a map from the Ministry of Tourism depicting the density of construction per area in Las Terrenas:

Do I need a realtor when purchasing new projects on presale?

It is entirely up to you. The large projects usually have their own sales team in place to promote the development. These sales teams are also remunerated with a sales commission included in the asking price, just like an independent broker.

Nevertheless, working with a realtor to represent you when purchasing pre-construction projects has its own advantages:

- Sales representatives directly represent the builder since they work exclusively for that person. From an independent realtor, you can expect him or her to look actively after your interest.

- An independent realtor has knowledge about the ongoing projects locally and can inform and guide you towards the best options. Your personal broker will always negotiate in your best interest the final conditions of the purchase to obtain a better price, favorable payment terms...

- A realtor will also send you frequent updates on the progress of the construction.

In the end, working with an independent realtor will increase your chances of making the right decision for your investment.

Discover here the Ongoing Projects on Presale in Las Terrenas

How to obtain the Dominican Residency?

To get the Dominican Residency, one needs to apply for a "Residence Visa" at a Dominican consulate in his/her country of origin. The applicant is required to provide several documents:

- A birth certificate

- Bank references

- A marriage certificate

- A police report

All of the above mentioned documents must be translated and apostilled in Spanish, the only official language in the Dominican Republic.

Apostilles authenticate the seals and signatures of official documents including notaries, birth certificates, court orders, and other documents that are issued by a public authority. By applying the apostilles, the documents are recognized in all member countries of the The Hague Convention.

PS: The fee for an immigration attorney to handle the first residency process is around US$1,200. Renewals are much less costly and easier to obtain.

The applicant will be required to proceed to a brief medical exam in Santo Domingo in order to receive the residency card